Lenders evaluate the month-to-month personal debt on monthly income to choose if your home loan are sensible. Ergo, it is best to keep your DTI – and this signifies what part of your income goes to your own construction and continual debt burden – as low as you can easily.

Whether or not your credit score won’t particularly reveal their DTI, you might calculate they yourself otherwise your financial helps you know it. An alternative choice is to use an online DTI calculator. It is best to speak with your own lender, though, because the particular on line calculators will most likely not offer the complete image.

Step: Lower Personal debt

You don’t have perfect borrowing from the bank to possess financial preapproval. But not, it is advisable to blow as frequently loans down because the you’ll be able to before you apply to have a mortgage, particularly if you enjoys a lot. Simultaneously, a cleanser credit score and you can a top credit score can help you earn a lowered interest rate.

Action 5: Save your self a downpayment

For some mortgage loans, you will want about a good 20% down payment to avoid investing individual home loan insurance rates (to have traditional financing) or mortgage advanced insurance policies (to own FHA home loans). The concept about both is similar. Lenders play with individual mortgage insurance policies and you may home loan superior insurance rates to guard on their own against losses. PMI and you will MPI cover your own bank for those who standard on your mortgage.

This does not mean you should lay out 20%, but it is something to look out for. Whatever the case, you’ll want to has actually fund arranged getting when you’re ready to put in a deal into a home.

Action six: Prepare for Closing costs

It’s hard in order to pinpoint exactly how much your settlement costs could well be while the for every single condition and you can situation disagree. But not, you might reasonably assume your settlement costs is anywhere between 2% and you may 5% of the residence’s cost.

Settlement costs can include mortgage origination charge, property taxation, a property profits, attorneys costs and you can disregard points, or any other will cost you. The vendor can get shell out any of these costs, but due to the fact a buyer might afford the people.

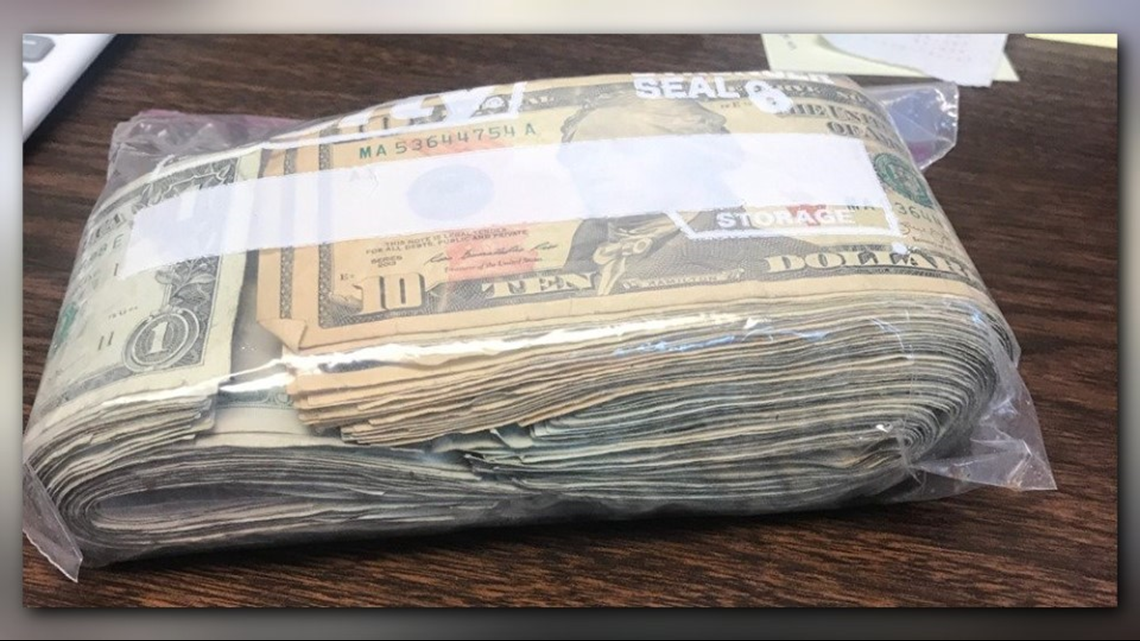

Step 7: Has actually Earnest Currency Saved

Earnest money is generally speaking in initial deposit of just one% to 3% of house’s really worth, though it could be all the way to 10%. So it good-faith paydayloancolorado.net/coal-creek/ deposit visits the vendor. They shows the vendor plus the seller’s broker your serious throughout the purchasing the domestic.

When you provide that it good faith deposit, you are able to signal a contract outlining the fresh new to acquire requirements and people contingencies. If the supplier break the fresh new terms of the arrangement, owner dangers shedding new serious money. On top of that, the level of brand new earnest money applies for the brand new down-payment of the home.

There are many different documents the financial will demand having a mortgage preapproval, however, here are a few of the biggest:

- Evidence of earnings

- A couple months off financial and you may monetary statements

- Government-provided character

- Personal information

- Possessions suggestions, in addition to a purchase price

The financial will counsel you regarding anything they need. Although not, to be sure a mellow home loan preapproval processes, bring all of the called for records as soon as possible.

Home financing preapproval is an important step to buying a house. By firmly taking the time to know what preapproval entails and you will gathering all of the needed documents, you could boost your likelihood of being approved to have a home loan. Speak with a specialist to learn more.

- LinkedIn reveals when you look at the the brand new windows LinkedIn

- instagram opens up in the the fresh new screen instagram

- facebook opens inside this new window fb

- twitter opens up within the new window twitter

- YouTube reveals in the the brand new screen YouTube

loanDepot Lives Be sure (“Guarantee”) – At the mercy of new criteria and make contact with conditions in depth below, the latest Be certain that applies to the brand new refinancing out of an outstanding loan began of the loanDepot which is shielded of the same assets upon which you to definitely debtor in earlier times received regarding loanDepot a loan and you can loanDepot Existence Guarantee certification. The Be certain that is actually low-transferable and will not connect with loans obtained to invest in a the new property, the brand new fund that make the creation of a special lien for the newest property (we.e., an excellent home security mortgage), res, and advance payment guidelines applications. The newest Ensure in addition to does not affect funds removed using third parties (elizabeth.grams., Financing Forest) or started through loanDepot’s General department. This new Be sure might only be used by submission a credit card applicatoin individually to help you loanDepot.

Leave a Reply