Property security line of credit (HELOC) allows home owners in order to influence the brand new guarantee they have already manufactured in their houses. Due to the fact residential property are some of the best things belonging to new average person, a HELOC try a powerful borrowing from the bank choice for of numerous People in the us.

By using your residence just like the collateral, you can access a credit line which can help spend to own everything from home improvements to college expenses and you can large-attention personal credit card debt. Focusing on how a good HELOC performs and you may preferred misunderstandings regarding it kind of out-of loan makes it possible to make more advised decisions whenever seeking out, having fun with and you will dealing with they.

A great HELOC is a type of covered mortgage, definition the fresh debtor offers some type of advantage as security. For an excellent HELOC, the fresh new borrower’s residence is brand new collateral. In such cases, lenders know they are able to recoup at least part of their financing if for example the debtor defaults. With security up for grabs renders lenders very likely to bring a loan for as long as individuals fulfill earliest qualifications. Good HELOC may promote all the way down interest levels than other type of financing.

With regards to the way they form having borrowers, HELOCs can be compared in order to playing cards. A great HELOC opens up a credit line that the debtor is, however, doesn’t have so you can, use towards the created credit limit. Borrowers up coming pay back the credit made use of and you can related focus. Yet not, its generally best to play with a beneficial HELOC having major expenses and you may credit cards to possess relaxed purchases.

These types of self-reliance lets property owners which need HELOCs to only make use of the finance when necessary. That it stands in contrast to many types of antique funds, the spot where the lump sum payment try given out therefore the borrower must upcoming begin paying down the primary and you may appeal.

There are couple limitations about precisely how the funds considering through this line of credit are invested

The new payment months follows this new mark period while having can last for several years. During this time period, borrowers pay the financial for the prominent and you can people more desire due.

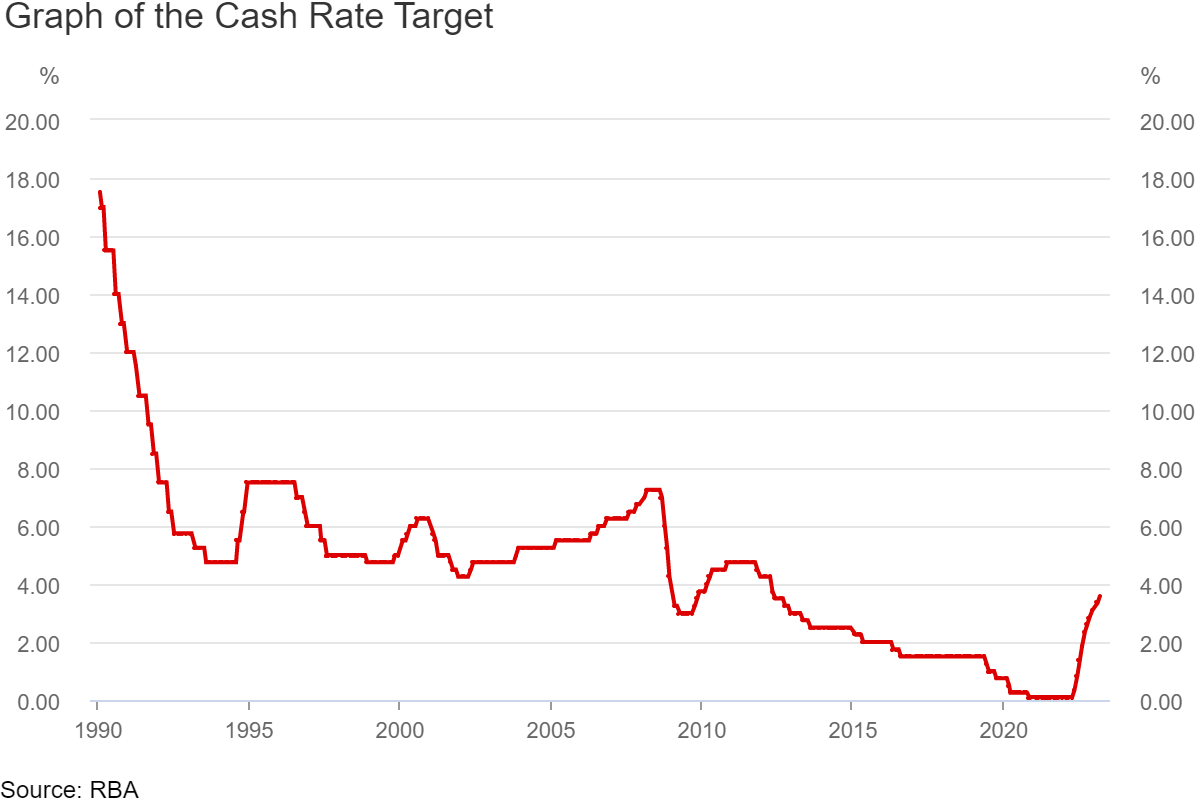

Whilst not exclusive so you can HELOCs, it is important to envision whether your financing has a predetermined or adjustable rate of interest. A varying interest try recalculated occasionally in accordance with the conditions set by the lender. This can build with your HELOC practically pricey inside regards to focus repayment, according to research by the larger financial points you to definitely dictate how focus price was modified https://paydayloancolorado.net/julesburg/. A fixed interest rate, which is less common to have HELOC fund, will remain steady. This method does not render possibilities to own discounts but is much more predictable.

HELOCs tend to be a suck period of years, the spot where the borrower can use the newest personal line of credit as they see match and are just expected to build notice costs

A HELOC are often used to get otherwise purchase nearly one thing. This might be a major benefit of an excellent HELOC compared to the finance that can only be utilized for a certain or thin selection of intentions.

Prominent spends out of HELOCs are generally tied to highest expenditures one to can be difficult to buy physically. A house can offer excessively security. Considering the well worth produced in of several land therefore the size of energy one to tickets through to the repayment months initiate for the HELOCs, it credit line often is used in significant requests. A few examples from smart HELOC usage were choice that may raise the worth of the possessions, improve your generating strength otherwise lower your financial obligation accountability, including:

- Purchasing household solutions and home improvements: Such points can add well worth so you can a property, although it is very important to seem on whether a particular venture can be considered helping increase resale well worth. Observe that shelling out for renovations is the merely sorts of HELOC personal debt that is certainly tax-deductible, after the code transform oriented because of the 2017 Income tax Cuts and you can Services Work.

Leave a Reply