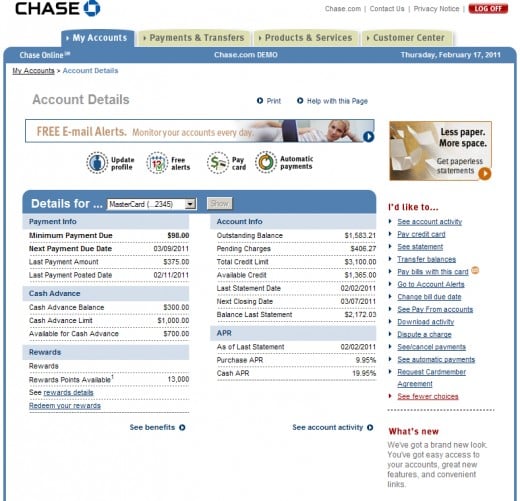

It is important to just remember that , handmade cards aren’t a keen endless funding, and that they need to be paid back regularly to help you prevent highest appeal money

No matter if credit cards could easily exacerbate obligations, when made use of lower than rigorous handle, playing cards would be incorporated a funds as a way to save towards the orders plus generate a good credit score. But not, particularly for whoever has restricted finances, it’s important to play with playing cards moderately to cease large focus costs which could strain spending plans even further. Please go to any of the calculators less than for more particular information or calculations.

It’s important to ensure that not to ever twice drop whenever bookkeeping having figuratively speaking, personal loans, otherwise credit card debt on funds. Which applies to student education loans and you can university fees and you will credit card balances are carried day-to-few days.

Once the costs associated with daily living may sound unimportant when as compared to most other categories, they may be able discreetly add up. A class having many move place during the improving a great finances are “Dinners Out.” Preparing in the home tends to be significantly more prices-efficient than just eating dinner out, and you may based on how tend to an individual has edibles out, food in more often can potentially lose cost of living by a good large amount.

“Food” and “Edibles Away” are included in the expense dysfunction regarding performance. As a whole, this combined expenses will be less than 15% cash.

In america, healthcare costs on $10,000 per year on average for every person. Sadly, this might be an amount one to fundamentally has actually little pliability in a great finances. But not, there are some steps which can be used to potentially eliminate medical care costs:

- Do not smoke, consume stronger, score many bed, and practice daily.

- Include in-community physicians, medical facilities, and you may business.

- Continuously re-evaluate medical health insurance need.

- Use income tax-advantaged membership that will be designed for medical care purchasing. In the You.S., this can be called a health Family savings (HSA).

- Purchase general drugs preferably.

- Elderly people can just be sure to reorganize the environment to treat the risks away from falling, because falling the most well-known situations conducive in order to a huge healthcare statement into old.

It was stated that a good investment for the studies ‘s the finest financing an individual can generate. Statistics reveal a leading relationship between high levels of knowledge and you can large earnings membership. These kinds probably keeps less regarding scaling back, but more related to planning for it precisely. Keep in mind that for the majority setup nations, pupil the assistance of government entities could be most accessible therefore that it does not matter someone’s financial reputation, he has got the capacity to getting higher education. Budgeteers incapable of pay off multiple high-attract college loans could possibly get consider combining them.

That have a child is one of many most costly (and you will time-consuming) expenditures for the adult, so it is vital that you policy for this economically. Please go to the hand calculators less than for lots more particular guidance or computations.

In healthy budgets, a lot of currency may be assigned money for hard times, with savings otherwise expenditures for old age, disaster finance, otherwise school deals. The main thing to have budgeteers never to ignore the requirement for an emergency funds; with one can possibly make-or-break in loans or perhaps not. When the offers and financial quicken loans Mulga Alabama investments is actually handled better, this is simply not uncommon to see average income earners retire in the before ages. As a general rule out-of flash, it is recommended into total of point as 15% or more. Please go to any of the hand calculators below to get more certain pointers otherwise computations.

It section of expenditures are the quintessential flexible in the a personal budget according to most other categories eg housing otherwise savings. It provides many expenditures which will slide in fuzzy contours of “needs” and you can “wants.” This departs loads of place for personal discretion, which will be a good otherwise crappy material. Crappy in this more than-expense is damage a spending plan, but a great because moderation is also convenience be concerned and you will probably repair a spending budget. Very important conclusion out-of whether to get a pricey excursion towards the Maldives, whether to sit-in a super Pan in town, or whether it is well worth using large amounts into the an art range significantly help for the reaching monetary goals. Luxurious getaways, loving pet, and you will fulfilling hobbies are common great ways to purchase oneself, on condition that economically possible. For anyone trying fix a failure budget, that it part ought to be the first urban area to check on.

Earnings

Credit cards hold negative connotations away from cost management because people have a tendency to make use of them to expend over they’re able to pay for.

Leave a Reply