New government government’s Domestic Sensible Amendment Program (HAMP) was created to help people who will be feeling a financial hardship. If you are found to be eligible for HAMP, after that your mortgage can be changed making your monthly financial fee only about 31% of your gross monthly money. For much more all about HAMP qualification and needs, visit .

But become informed: trying to get financing amendment may well not avoid a property foreclosure. There were instances in which residents have obtained their houses ended up selling within foreclosure if you are their amendment apps remained pending. You should take action quickly for folks who discovered a realize that your residence will be foreclosed to the of the owner of the mortgage.

New And come up with Family Affordable Program try a national system applied of the the us Company of the Treasury and the Agencies out-of Homes and you may Metropolitan Development. It has a number of options getting people, many of which are available thanks to private loan providers, including:

What’s more, it will give you the ability to request that your particular membership feel fixed, if you feel the lender otherwise servicer has made an error

- Mortgage refinancing financing from House Reasonable Re-finance System (HARP);

- Loan variations to possess very first and second mortgages from Domestic Sensible Modification Program (HAMP) and the Second Lien Modification Program (2MP);

- Getting short-term assist with underemployed homeowners from the Household Sensible Jobless System (UP); and you may

- Providing other alternatives in order to property foreclosure through the Domestic Affordable Property foreclosure Solutions System (HAFA.)

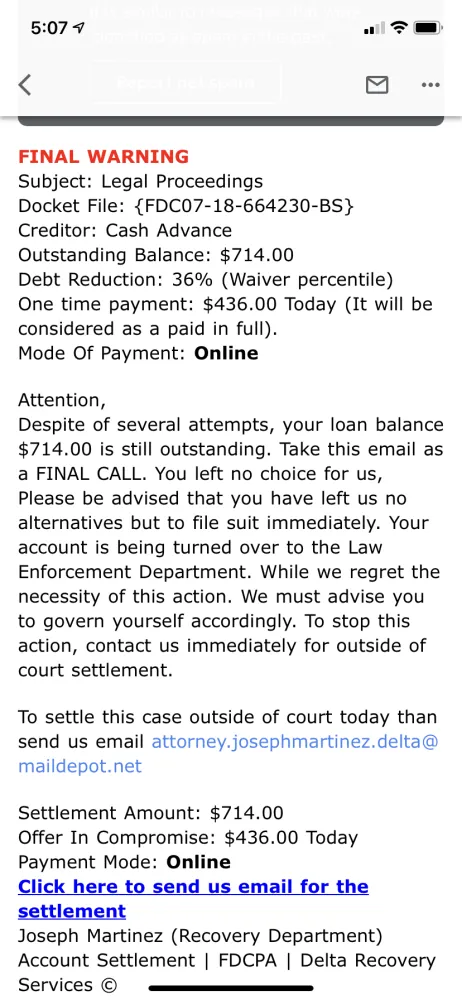

Maybe … and perhaps not. Many companies adverts these services try ripoff artists who steal money off disappointed home owners by using upfront charge and never providing with the their claims. Below are a few methods for distinguishing frauds and what to do if you feel that you’ve been a prey:

What’s more, it gives you the ability to demand that account end up being corrected, if you were to think the lending company or servicer makes a blunder

- Cannot shell out a payment for assistance with otherwise pointers towards Making Domestic Affordable Program.

- Stay away from people otherwise organization you to definitely requires you to shell out an initial percentage in exchange for a sessions provider, property foreclosure cures, or modification of an unpaid loan.

- Beware of anybody who desires one to signal across the deed to your house to save your valuable house.

- Watch out for anyone who suggests one to on purpose skip home financing percentage.

- Never Windsor loans build your mortgage repayments so you’re able to anyone aside from their home loan proprietor, unless you have the mortgage holder’s approval.

In order to document a problem or to score 100 % free information about swindle or other consumer factors, call the Homeowner’s Pledge Hotline within step 1-888-995-Hope (4673) otherwise get in touch with theFederal Trading Payment on otherwise 877-FTC-Assist (4357). As well as contacting brand new FTC, you’ll be able to need to document a criticism with the Governor’s Office out of Consumer Shelter of the getting in touch with 404-651-8600 or toll-free within 1-800-869-1123. To learn more on foreclosure cut or loan mod scams, see , or .

The fresh federal Home Payment Measures Operate, several U.S.C. Point 2605(e), will give you the legal right to request information about their financial account. At the conclusion of it web page is actually take to letters that you can use so you can request guidance, or even ask your servicer right your account. Make sure you demonstrably choose the name of your own borrower given that it appears towards the servicer’s facts, the fresh membership count, additionally the property target. Federal laws necessitates that the lending company otherwise servicer acknowledge your letter contained in this twenty months, and you may address they inside sixty weeks.

Georgia was a great non-judicial foreclosures condition. Which means the lender can also be foreclose on your own domestic as opposed to submitting fit otherwise lookin inside courtroom just before a court. The fresh steps having property foreclosure try spelled in the official Password from Georgia, Parts forty-two-14-162 thanks to 49-14-162.4.

Leave a Reply