Likewise, Those who was indeed immediately after Indian because of their passport but now have yet another passport within their bag is also allege this new standing out-of Individual from Indian supply whereby he/she can also get property/plot/apartment from inside the Asia. It standing is even practical of these whose grandparents, moms and dads and you will higher grandparents who were immediately following owners out-of India; thus however they fall under the course of Individual out of Indian origin.

So many individuals from these 2 kinds are prepared to purchase a house/land/apartment in India through which it present a feeling of love due to their motherland. Here is the easiest way for them to get a home in the Asia.

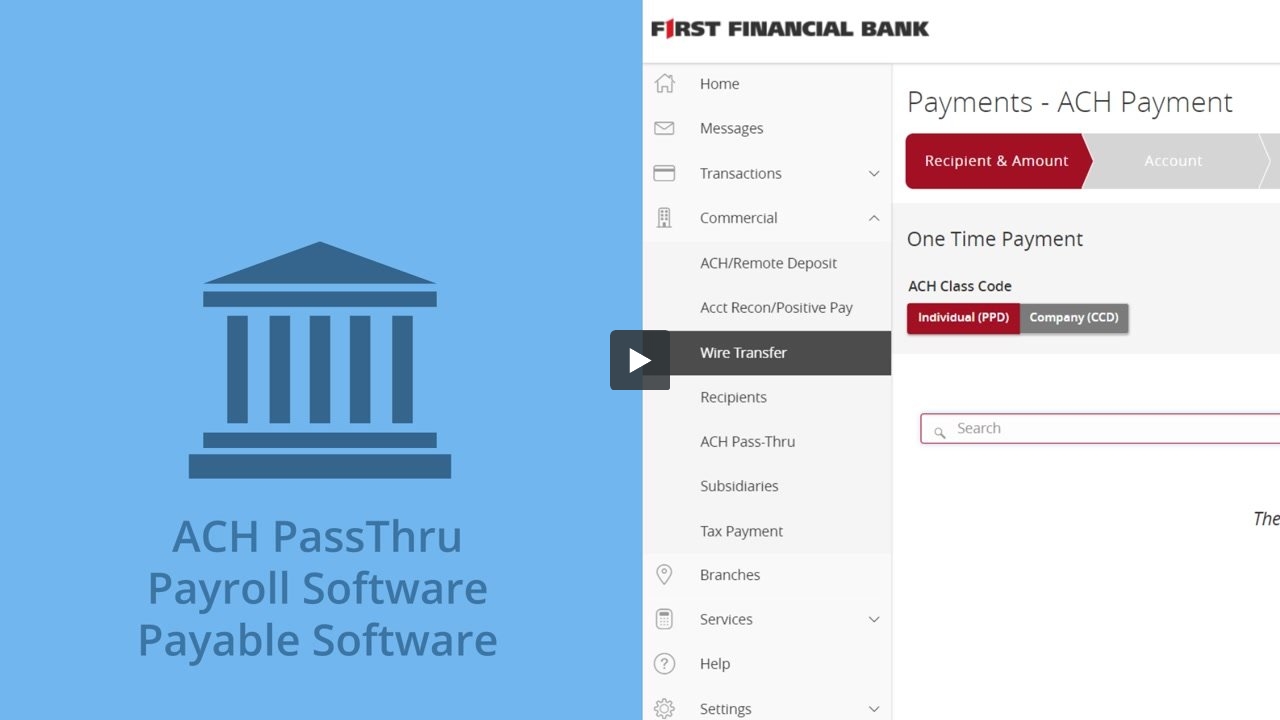

Into the NRIs Indian Lender brings mortgage brokers to invest in for a dream domestic from inside the Asia; in addition allows the fresh new NRI get a plot in the Asia on the he can also be build a property regarding his own options. The procedure is rather simple and to follow, that have assistance to possess th NRI to enroll in this system 24*7.

Purchasing a house in India if you find yourself seated to another country try good portion hard employment on paper, while the Indian property regulations succeed hard to purchase possessions easily. Indian bank’s lenders getting NRIs give you the choice out-of incorporating an effective co-applicant in your software on the mortgage that enables the newest lender to make use of brand new co-candidate once the main borrower of one’s mortgage, it is you’ll as you possibly can assign this new co-candidate (mandatory) the effectiveness of lawyer for which the guy/she’s going to capture choices for you letting the to invest in of the home/land/flat feel convenient.

Of the such steps, brand new NRI otherwise PIO cannot need to see your website of one’s topic actually once, all that will be identified by the applicant is recognized over the full web webpage out of Indian Financial and that allows you track brand new updates of the software on the internet at your convenience.

Who is exempted from this financing?

An individual off any of these nations viz. Pakistan, Afghanistan, Bangladesh, Asia, Iran, Bhutan, Sri Lanka and you can Nepal. They are excused out-of trying to get that it strategy.

About Indian Lender Home loan

Perhaps you have adequate money to buy your dream domestic? Would you pick a lower than-design flat or able-to-move-when you look at the property? Have you chosen your following family? If you have chosen the next home while know the way far count you should missing to buy your dream assets. When you complete your perfect assets, you should know the worth of an equivalent. When you are buying a significantly less than-build property, you have to pay extent into the stages. But if you are going for able-to-move-from inside the, you are designed to build commission in 2 payments. You pay new token money as your first payment, followed by a complete payment of your remaining count. For the reason that circumstance, you are meant to make the complete fee in a month otherwise one or two. In the current industry problem, the brand new pricing of every property, should it be a condo, flat or property ‘re going skywards and so you have to use the mortgage purchasing a similar. Either you is taking financing to your limit really worth or proportionate to your offers. Ideally, you’d like to obtain the mortgage to an expense which can help you buy the home along to your offers you really have.

Indian Bank has the benefit of mortgage so you can consumers for selecting a unique assets, renovation/repair out of home, getting financing top-up-and to acquire a story. The bank can offer your a mortgage for an amount of loans Arboles INR 75 lakhs. The most period on financing is actually 20 years. The lending company charges a separate interest to have a separate count. You can select from the brand new fixed and you can drifting rate of interest. Floating and fixed interest vary in nature and you pay yet another amount predicated on the period in addition to availed amount borrowed. Let us grab reveal look at Indian Lender home loan.

Leave a Reply