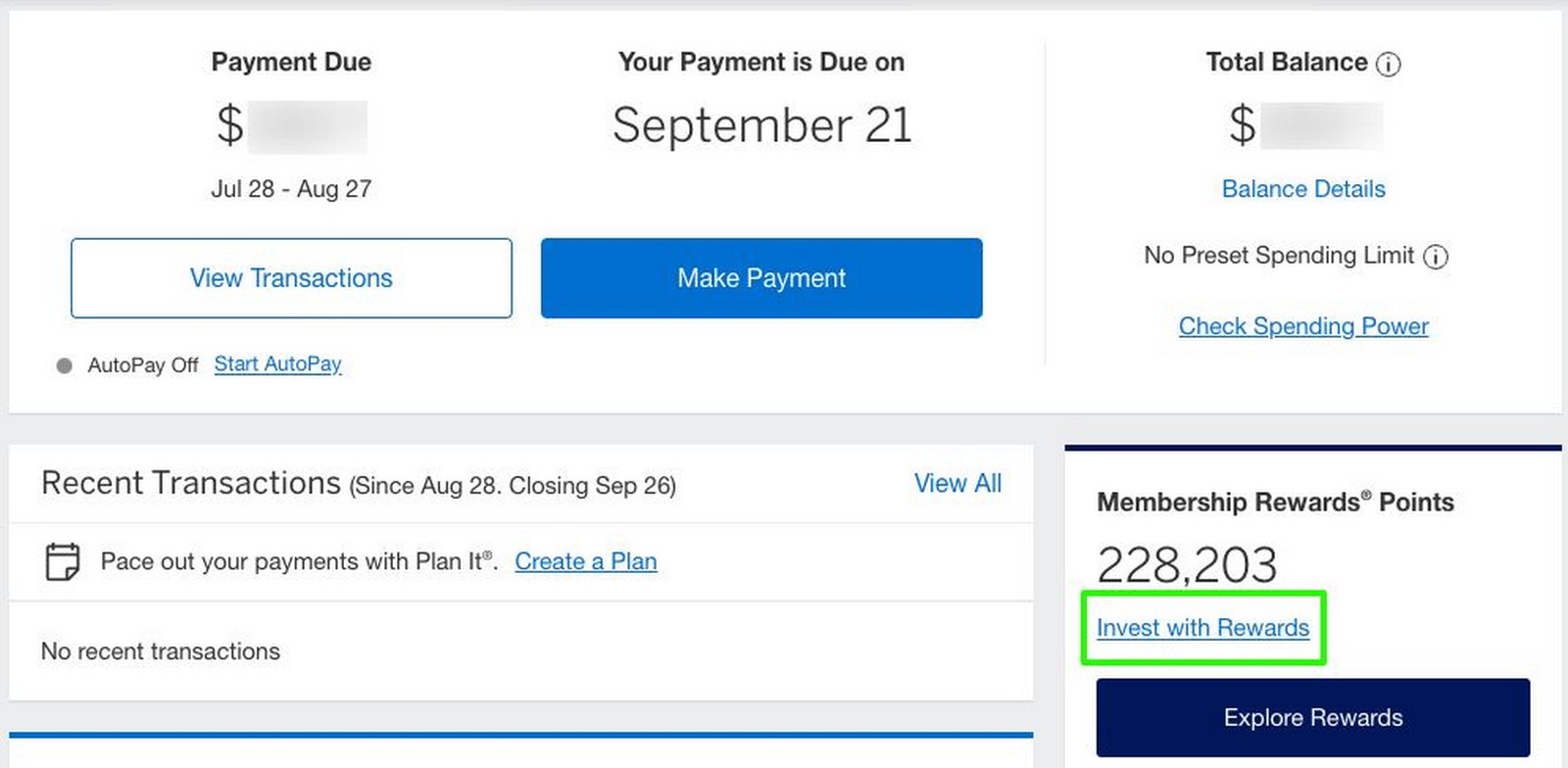

Once you pick a house, you begin to construct equity through the years. You need the fresh new collateral that you have gathered so you’re able to get a house security personal line of credit, otherwise a good HELOC. A great HELOC was a credit line covered buy your household that delivers your a good rotating credit line for higher costs or perhaps to consolidate large-interest debt. An excellent HELOC is perfect for homeowners who need use of money more than decade particularly for do-it-yourself programs that comfortable employing household while the guarantee. An excellent HELOC will provides less rate of interest than many other old-fashioned loans as well as the desire is tax-deductible.

Why does an excellent HELOC Performs?

Good HELOC uses the fresh security (the difference between their home’s value plus financial balance) built up in your home due to the fact collateral. HELOC financing render aggressive interest rates that are popular with most recent residents who require a little extra cash to have renovations or to shell out of obligations.

Good HELOC is offered into debtor because the a variety of a credit card and supply them entry to a line of credit to mark regarding and you can pay as required. A beneficial HELOC can be obtained to have a-flat time period, constantly up to a decade. If the line of credit period of time concludes, borrowers often enter the cost period that may last doing two decades. You will only pay the latest an excellent balance that you borrowed together with one interest due.

The way to get an effective HELOC?

HELOC fund usually become once the a changeable rates mortgage and you may do https://elitecashadvance.com/payday-loans-nc/ perhaps not normally need borrowers to invest closing costs. Continue reading

Recent Comments