But understanding COGS can help you better understand your business’s financial health. The LIFO method will have the opposite effect as FIFO during times of inflation. Items made last cost more than the first items made, because inflation causes prices to increase over time. The LIFO method assumes higher cost items (items made last) sell first.

Limitations of COGS

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. See first-hand how to boost manufacturing efficiency and reduce your cost of goods manufactured with a risk-free two-week trial of Unleashed. For a clearer idea of how the COGM formula works, let’s look at a hypothetical example.

The cost of goods manufactured formula

The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales. This deduction is available for businesses that produce or purchase goods for sale. Its primary service doesn’t require the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs. Input your data into the calculator below and read more about using the COGS calculator.

Our Services

Twitty’s Books began its 2018 fiscal year with $330,000 in sellable inventory. By the end of 2018, Twitty’s Books had $440,000 in sellable inventory. Debit your COGS account and credit your Inventory account to show your cost of goods sold for the period. When you purchase materials, credit your Purchases account to record the amount spent, debit your COGS Expense account to show an increase, and credit your Inventory account to increase it. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

COGM in a manufacturing ERP

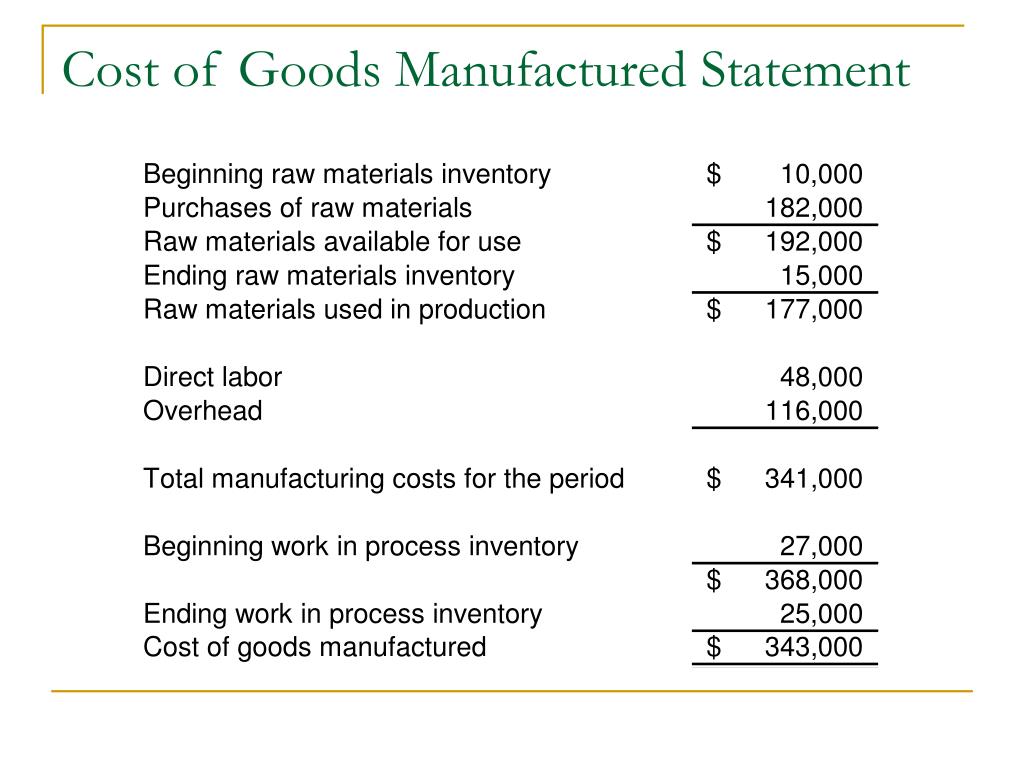

Notice the relationship of thestatement of cost of goods manufactured to the incomestatement. Knowing the cost of goods manufactured is vital for a good overview of production costs and how they relate to the bottom line. COGM also allows management to identify cash drains, adjust prices, and track the development of the business. what is a post closing trial balance definition meaning example Cost of goods manufactured is the total cost incurred by a manufacturing company to manufacture products during a particular period. Once all relevant data is captured and allocated, the software automatically calculates the total cost of goods manufactured for each production order or batch by applying the COGM formula.

How do you calculate cost of goods sold in a service business?

We add cost ofgoods manufactured to beginning finished goods inventory to derivecost of goods available for sale. This is similar to themerchandiser who presents purchases added to beginning merchandiseto derive goods available for sale. To make the manufacturer’s income statement moreunderstandable to readers of the financial statements, accountantsdo not show all of the details that appear in the cost of goodsmanufactured statement. Next, we show the income statement forFarside Manufacturing Company.

In practice, most modern manufacturers use MRP software with perpetual inventory systems that calculate WIP automatically and continuously. The cost of goods manufactured for the company during April is $34,000. This represents the total cost incurred by the company to produce the mountain bikes during that month.

Learn how Unleashed helps you track all your production costs to provide an accurate picture of your COGM, profitability, and cash flow that’s consistently updated in real time. In order to determine the actual direct materials used by the company for production, we must consider the Raw Materials Inventory T-account. Raw materials inventory refers to the inventory of materials that are waiting to be used in production.

- In the final accounts the manufacturing account is usually presented in a more readable format.

- For information on calculating manufacturing overhead, refer to the Job order costing guide.

- As prices increase, the business’s net income may increase as well.

- During inflation, the FIFO method assumes a business’s least expensive products sell first.

The manufacturing cost of goods completed for an accounting period is calculated using the cost of goods manufactured formula as follows. Keeping an eye on COGM is important because it enables manufacturers to scope the expenses involved with producing goods, analyze the profitability of their operations, and also calculate the cost of goods sold (COGS) KPI. While accountants can approximate its value at the end of fiscal periods, modern inventory and manufacturing software calculates COGM in real-time, based on actual manufacturing data.

To calculate the cost of goods manufactured (COGM), first add up all the costs incurred during the manufacturing process within a specific period. Calculating and tracking COGS throughout the year can help you determine your net income, expenses, and inventory. And when tax season rolls around, having accurate records of COGS can help you and your accountant file your taxes properly. Determining the cost of goods sold is only one portion of your business’s operations.

National Home Products uses direct labor-hours in all of its divisions as the allocation base for manufacturing overhead. Underapplied and Overapplied Overhead LO3-4Osborn Manufacturing uses a predetermined overhead rate of $\$ 18.20$ per direct labor-hour. This predetermined rate was based on a cost formula that estimates $\$ 218,400$ of total manufacturing overhead for an estimated activity level of 12,000 direct labor-hours. For other business structures, the deduction still applies but might be reported in different forms corresponding to their tax filing requirements.