Your generally speaking can not generate more than their area’s median earnings (AMI). Family earnings limit will be based upon your family members size. It limit ensures that assistance is offered to people who you need it extremely, according to local economic criteria.

Minimum credit rating conditions

The absolute minimum FICO rating off 620 in order to 640 is normal. With good credit displays to lenders and recommendations applications that you have a track record of handling credit sensibly plus the capability to repay fund.

Assets criteria

Always, the house or property must be a single-home used since your top home. There is going to additionally be purchase price constraints. This assurances the applying experts some one and you may group payday loan Elkmont trying to a house for personal occupancy, as opposed to buyers. Specific software may keep the acquisition of condos otherwise townhomes lower than particular requirements.

Financing sort of

Specific teams provide official mortgage loan applications to be used next to closure prices advice and you may down payment grantspatibility may vary, which includes programs flexible a variety of financing designs, away from traditional loans so you can government-recognized FHA, Virtual assistant, and USDA financing. That it independence allows applicants to select the best loan device to own its disease.

Homebuyer standing

Some applications are supplied to help you each other repeat and you can first-big date people; anybody else are for first-date homebuyers merely. Most applications define earliest-time consumers as the anyone who have not owned a property throughout the past 36 months. So it huge difference support address guidance of these going into the housing market the very first time.

Homebuyer training

Individuals are often necessary to complete an effective homeownership program, will but a few occasions long and available. This type of educational classes help customers to your expected information about to get and you can home ownership, off managing earnings to wisdom financial possibilities.

You.S. house

People need usually end up being owners otherwise signed up customers of one’s Joined States. This needs implies that help with settlement costs is out there in order to individuals with courtroom updates in the country.

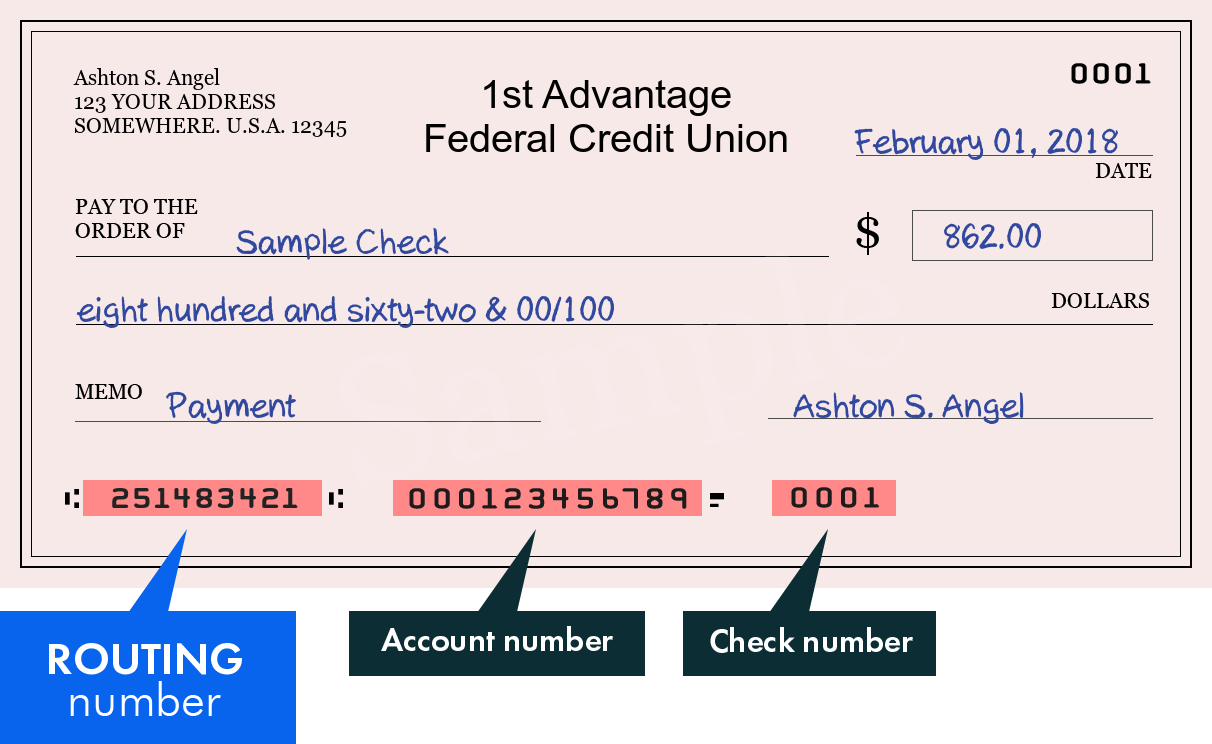

Papers

- Tax statements

- W-2s, pay stubs, and other proof of money

- Lender statements

- Proof of You.S. residence

While you are trying to get a program that requires that getting a primary-date home consumer, you may want to must provide proof that you definitely have not possessed a house previously 3 years.

Because of the meeting these types of requirements, prospective homebuyers is browse the entire process of qualifying to possess closing cost recommendations better, putting some dream of homeownership much more achievable and you can renewable.

Protecting closure costs assistance helps make a positive change on your own real estate travel, especially if you may be a primary-date home visitors selecting advice about closing costs.

Replace your credit score

Increased credit history besides improves your odds of qualifying getting home financing however for closing rates direction has. Begin by checking your credit score the problems and dealing into repaying a fantastic expense.

Constantly while making on the-go out payments can slowly change your score. This can be crucial as the many provides for settlement costs enjoys minimum credit score conditions.

Get pre-recognized to own a home loan

Obtaining home loan pre-acceptance tells offer company that you are a serious and you may qualified consumer. They shows that a loan provider has examined the money you owe which can be prepared to provide your a certain amount. This step is significantly enhance your application to possess closing cost grants.

Cut getting a downpayment

While you are protecting to own a downpayment might seem counterintuitive whenever seeking to direction, which have some cash saved can display economic obligation and you may union. Particular closing rates recommendations programs need one to contribute a certain percentage toward deposit or closing costs, very with savings increases your odds of qualifying.

Leave a Reply