From this post

USDA financing create homeownership possible for tens and thousands of reasonable-earnings Us citizens inside the rural section. This type of reduced-interest, zero-down mortgage loans are not as well-called their FHA otherwise Va loan equivalents, nonetheless they include several advantages that make certain they are good choice for eligible consumers.

In many cases, homebuyers can use good USDA mortgage to order a made house – one that’s developed out of-site prior to being transmitted and attached to an in-website, permanent basis. Also particular modular belongings, which are built in areas and assembled on location, may qualify for USDA financing.

Sure, individuals can loans a manufactured household through the You.S. Agency out-of Agriculture’s Single Nearest and dearest Houses Protected Financing System (SFHGLP). They should nevertheless see general USDA criteria to have possessions venue and you will money limits. These tips are different because of the state, so be sure to read the newest restrictions and you can restrictions inside your neighborhood before you apply.

Past one to, certain USDA are manufactured mortgage assistance are in place. This new borrower need certainly to fulfill these tips including general USDA conditions in order to be considered.

USDA Are manufactured Family Direction 2024

Even if USDA loans are apt to have loose conditions than FHA otherwise Va funds, there are still a number of assistance to follow when it comes to using such money purchasing a manufactured household.

USDA Financing Property Conditions

Decades and you may structure: Your own are built household must be the newest inventory, dependent in the last 12 months and never installed on a special site. It can’t getting changed apart from adding decks, decks otherwise equivalent structures, given that accepted and examined because of the regional password officials. You should also provide a duplicate of all of the manufacturer warranties and you will specialist and you will contractor criteria. The house must screen a yellow certification label to your outside of any lightweight point. So it Need to remain noticeable whatsoever required tasks are completed so you’re able to complete the installment.

Size: Are produced solitary-wider house need to be at least several foot broad. Double-wides should be about 20 feet large. Every are produced home need an area of about eight hundred sqft.

Safety: Are manufactured home need satisfy Federal Are created Household Structure and you may Protection Criteria (FMHCSS). Such guidelines make sure the homes is safe to have occupancy. However they will vary, dependent on where in fact the family would-be place.

Location: The house must be attached to end in an approved, USDA-qualified town and you can affixed to help you a permanent basis. Your website have to meet current floodplain conditions and can include proper spend convenience solutions and you can drinking water access.

Income tax position: Getting income tax motives, new are made family need to be classified since a house, and its particular web site have to be zoned a comparable.

Just like any mortgage, the lender will require property assessment to evaluate the above items and determine the complete value of the are available home and its particular homes. This will be must determine your own limitation amount borrowed. The brand new closure procedure having were created house might are name import and you will people called for records.

Is actually Mobile Home USDA Qualified?

The fresh new terminology are designed and you will mobile family are often used interchangeably, but there’s a significant distinction in terms of whether they truly are qualified to receive USDA money.

Cellular land will vary from are manufactured land in that he’s got rims, commonly connected so you can a long-term basis and so are maybe not classified as real estate. Mainly because style of residential property are believed personal property, they’re not eligible for a good USDA mortgage.

Was Standard Homes USDA Eligible?

For example are manufactured homes, standard belongings are primarily constructed for the a plant. These include centered-when you look at the prefabricated “modules,” which can be after that gone to live in a specific area, in which he is put together and you can connected to a long-term foundation.

Manufactured residential property take place so you’re able to government standards lay of the Agencies of Housing and you may Metropolitan Innovation (HUD). Modular property need to adhere to an identical local, state and you can regional building requirements necessary for on the-site house, meaning that they’ll will vary according to the area.

There is you to definitely very important caveat for making use of a good USDA financing to finance a modular family. You cannot utilize the financing buying homes then set up a standard family on it. Simply put, your standard residence is merely eligible for USDA funding just after its already been mainly based and you will installed with its permanent area.

See how Much House You really can afford Which have an excellent USDA Loan

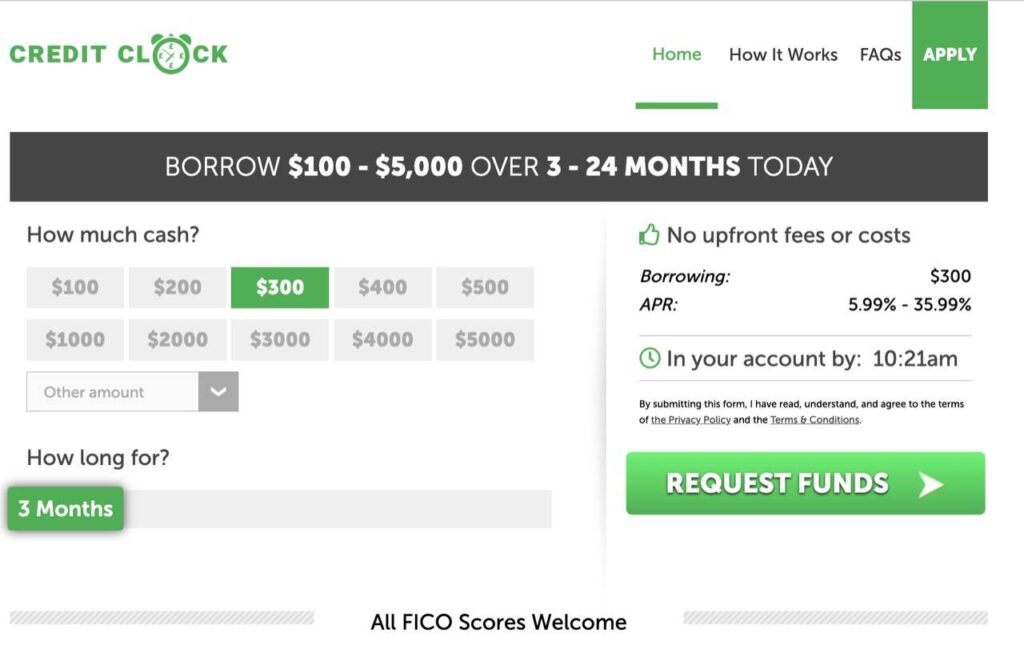

USDA funds was a strong financing product cashadvanceamerica.net 400 credit score loans of these finding to acquire belongings from inside the rural portion. With no down-payment specifications and you may lowest-rates, these finance is a stylish selection for many buyers.

Regardless if you are finding financing a manufactured family, standard home or to purchase a preexisting domestic in the an outlying town, an effective USDA mortgage is really worth offered. Natives Bank is prepared and certainly will advice about your property mortgage requires. Touch base today to find out more about USDA fund or any other form of money.

Leave a Reply