Editorial Guidance

Understanding how to read through your own month-to-month financial declaration allows you to monitor how quickly you are paying your loan, and help you room one transform on percentage otherwise who you are and work out your instalments to.

On this page

- What is a mortgage declaration?

- Exactly what home financing declaration looks like

- Why you should discover their home loan statement

- Learning to make a home loan payment

What is actually home financing statement?

A home loan statement is an accounting of all of the facts regarding the home loan, for instance the current balance due, desire charge, rate of interest alter (if you have a varying-speed home loan) and you will an article on your and you can earlier payments.

Mortgage brokers try legitimately required to give you a home loan report for each and every battery charging course inside lifetime of the loan. The file has particular financing guidance when you look at the a simple style, and that means you know the way for every money of mortgage repayment was spent.

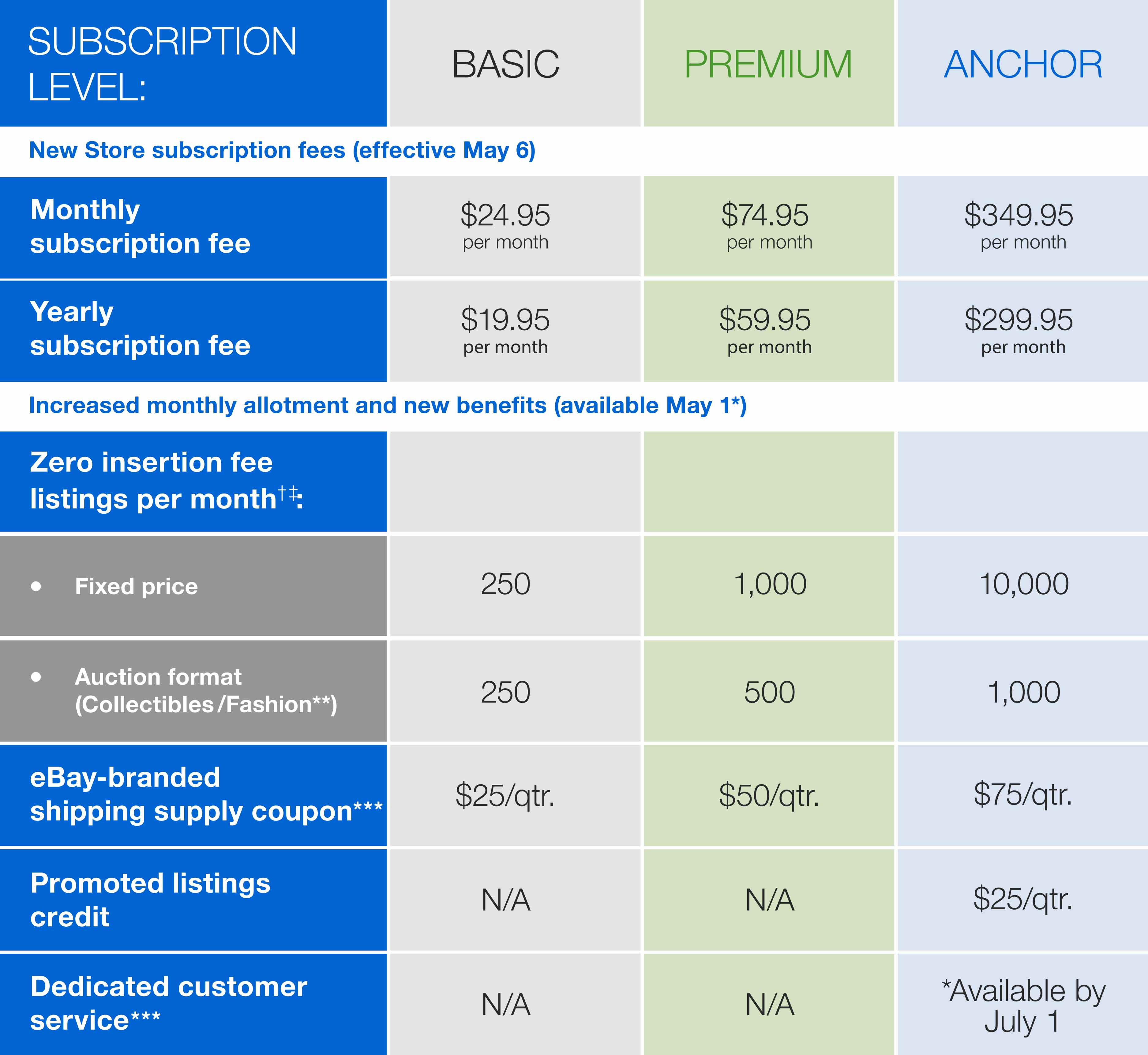

Just what home financing statement works out

The consumer Financial Safety Agency (CFPB) created a sample file to the the web site, and that LendingTree adjusted below to describe for each section of their home loan statement. Follow the numbers about visual lower than getting a paragraph-by-part writeup on exactly what the report tells you.

step one. Mortgage servicer suggestions

Home financing servicer ‘s the providers that accumulates your repayments and makes their month-to-month comments. (Observe that they age business you signed your loan having.) Brand new servicer’s contact info should be exhibited here, in order to come to these with questions concerning statement.

dos. Account matter

Your account or financing amount is linked with your term and the house which is funded by mortgage. You’ll want to feel the loan matter helpful while getting in touch with the loan servicer having questions relating to the mortgage.

Mortgage repayments are generally owed on firstly a week, regardless of if really servicers make you an elegance age of 2 weeks beyond the deadline ahead of payday loan Siesta Key you may be energized a belated payment. But not, so long as you improve percentage within 1 month off the brand new due date, your credit score wouldn’t show the fresh payment as the late.

Your mortgage payment is actually officially later if you don’t pay it from the first of the fresh day. Their report includes a great in the event the paid down after count complete with a belated fee, that is normally energized if one makes the fee pursuing the fifteenth of one’s day.

5. A fantastic prominent amount

Here is the count you still owe on your own home loan immediately after to make your payment per month. For every fee you make reduces your prominent, and you will generate more payments to repay the financial prior to. However, you may have to alert their servicer on paper that you wanted most financing applied to the prominent harmony.

six. Readiness go out

Particular statements range from your readiness time, therefore you’ll know how close or much you are away from spending from any equilibrium. Understand that if you make more repayments, the latest date will be in the course of time once the you might be paying down the borrowed funds smaller.

eight. Interest

Focus is the charge you spend in order to borrow funds, and it’s really in accordance with the financial price you closed inside the before you finalized the loan. For folks who go through the amortization agenda you’ll have gotten along with your closing documentation, you can notice that the majority of your payment goes to need for early numerous years of the loan.

Be mindful of so it point when you have an adjustable-rates home loan (ARM), to help you understand if your rate change. The loan servicer need give you see regarding up coming alter within minimum 60 days up until the fee deadline associated with the brand new very first and then price adjustments. Playing this information may help you decide if its for you personally to re-finance of an arm so you’re able to a predetermined-price mortgage.