It is no amaze to discover that providing onto the houses steps continues to be appearing become challenging for the majority perform-be very first-date customers. We have read in earlier times your Financial out-of Mum and you will Dad has proven as an effective supply of money to own particular consumers. not, present reports suggest those people thinking of buying their earliest property is trying to stretched mortgage loan episodes, as well.

Rates found about Mortgage broker Ltd demonstrate that the number of people taking out an effective British home loan more a 35-season identity has actually doubled from inside the prominence for the past a decade. Previously, merely eleven% out of consumers within this classification picked a phrase it much time. Now, it’s got trebled to help you 33.2% off first-go out buyers.

The common home loan identity likewise has increased

A twenty-five-seasons mortgage title was once the product quality length of mortgage most people manage choose. It offers now altered and the average identity is about 27 many years. With several the brand new customers looking for it difficult locate a fair deal, one obvious option is to give living of one’s mortgage in itself.

The fresh new trend is additionally present in the huge miss on part of users who have plumped for more-common twenty-five-seasons label. A decade ago, 59% away from users chose that financial label, while this year has viewed this figure shed in order to 21%.

Significantly more down monthly payments

The majority of people see the 35-seasons mortgage several months because an obtainable cure for get rid of the monthly obligations, told you Darren Pescod, Ceo of Large financial company Restricted. In some instances, it might result in the difference in having the ability to conveniently afford paying the financial or wanting it difficult and work out those payments.

With many challenges up against young adults making an application for onto the housing steps, you can easily see why most people are lured to choose an extended percentage title. But not, it does indicate certain will still be investing the financial on senior years, dependent on after they take it out.

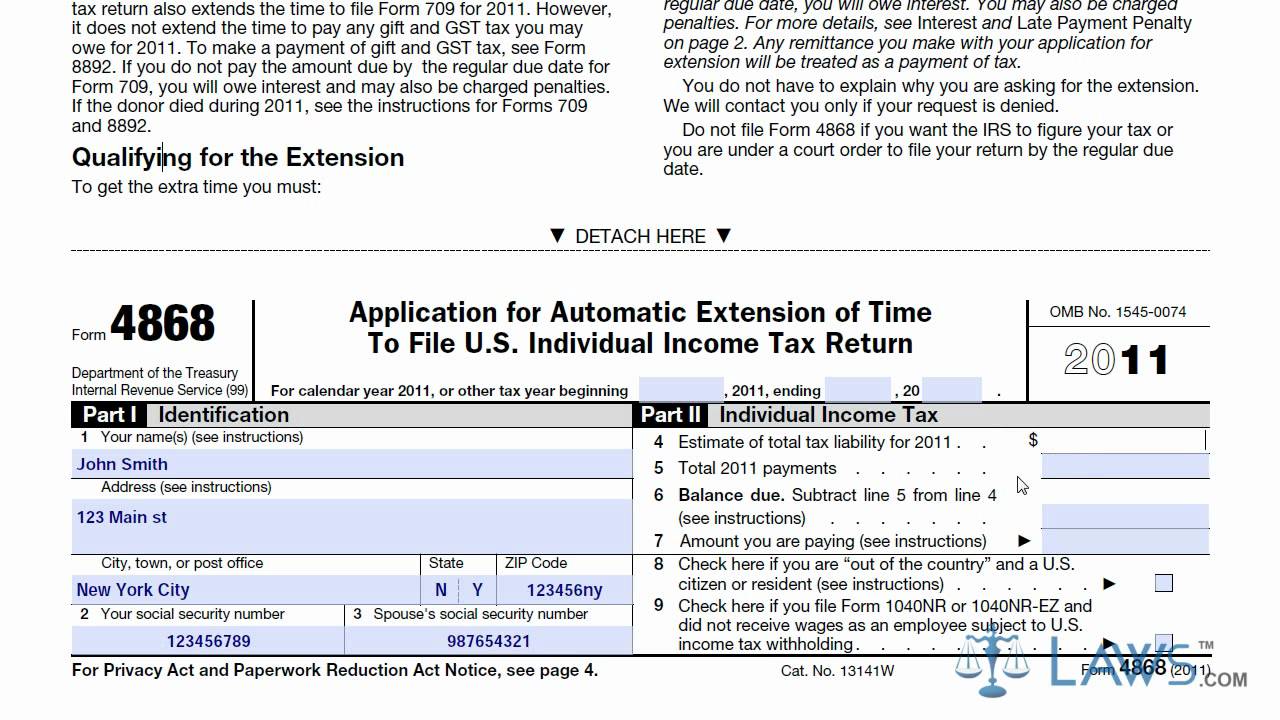

This new chart lower than reveals brand new monthly rates predicated on a ?200,000 payment home loan with a believed rate of interest off dos.5%.

Clearly on over, the difference in expense out-of a twenty-five-year home loan identity on ?897 per month compared to the 35-season financial name within ?715 monthly are a distinction regarding ?182 per month.

The essential difference between a get redirected here mortgage of 35 age and another out-of 40 years, however, is only ?55 monthly. It is ergo we recommend that readers constantly get this to testing and then try to secure the smallest home loan title likely that try sensible for you.Amount to acquire (?)Title (Years)Appeal (%) Determine

The sphere Need to be numeric, therefore ?375,000 try 375000? /moPlease Mention: These rates is actually for illistrative intentions only, and can even differ based your indivial things.

But a warning about the overall installment count

Not simply really does the fresh new lengthened mortgage label suggest the end day was pushed then right back, it setting the overall matter paid off is much large. One of these indicated a beneficial ?150,000 mortgage bought out 35 many years as opposed to twenty five years carry out become ?137 smaller four weeks, provided mortgage loan regarding dos.5%.

Yet not, the overall repayment do spring up by over ?23,000. To make the family budgeting easier for a while, consumers are also purchasing far more along the lasting. Going for a home loan and you will making sure it is reasonable is definitely will be an essential economic choice. These types of rates inform you exactly how true that is.

We could in fact end up being viewing a separate development with the longer mortgage words. It is hard to imagine consumers opting for smaller financial terminology in case your only way capable get onto the casing hierarchy before everything else is through an extended financial label. The brand new press on earnings is also prompting people to appear in the easing month-to-month home loan repayments. Until so it changes, it appears possible that a thirty-five-season home mortgage label may become more widespread regarding the upcoming decades.

Leave a Reply