If you find yourself Va funds has actually plenty of benefits having pros, they are notorious if you are hard to safe. You’ve got read from the rumor mill that it’s harder to shut towards the a good Va financing than many other traditional loans; although not, interested home buyers should not let this traditional wisdom play the role of a discouraging factor.

Closure toward a house with an excellent Virtual assistant mortgage changed away from bureaucratic ball-dropping and become much easier to support thanks to formal loan providers with the ability to improve the method for the-household. Currently, there are no tall differences when considering closure into property that have an excellent Virtual assistant mortgage versus other mortgage designs.

That being said, Champion Loan are prepared to show exactly how closure on the good Virtual assistant loan even compares to closure to the other kinds of funds.

Based on top financial app business Ellie Mae, it needs an average of 47 months to shut to your Traditional and you will FHA financing models. Closure towards that loan hinges on numerous affairs dependent on necessary prepared episodes and 3rd-team providers. We have found a timeline of procedures one to details the typical closure means of a consistent financing:

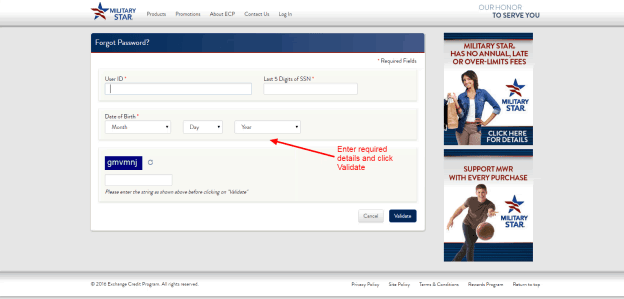

- Application. The newest curious family visitors submits an application to the go out one to. Attempt to bring their lender with your title, the Societal Shelter amount, your estimated gross income, the house or property address, the newest estimated value of the house or property, in addition to requested amount borrowed. Thank goodness, Hero Loan can facilitate this action.

- Disclosure. Creditors ought to provide an alternate Closing Disclosure showing the genuine conditions of transaction at the very least about three business days prior to property client signs the borrowed funds documents. With this process, interested homebuyers can get that loan imagine. It is recommended that homebuyers provide consent so you can coincide electronically in order to expedite the method.

- Paperwork. Your bank will take a couple weeks to look at new files required, such as your earnings or any other financial possessions, when choosing your loan eligibility.

- Assessment. As soon as you give the bank along with your signed intent so you’re able to just do it mode, an expert appraiser needs one to two days so you’re able to appraise the worth of the mandatory household for sale.

- Underwriting. The bank takes one three days so you can carry out an very first article on their borrowing and you can financial history to determine their qualification for a loan system.

- Conditional recognition. Your own financial will take step 1-two weeks having an extra underwriting review and you will cleaning regarding conditions to determine when they ready to mortgage a certain amount of money, given the fresh applicant match particular standards. A file can also be suspended because the pending or denied totally in the event your application will not meet up with the put criteria.

- Eliminated to close. This is the step where your own lender provides confirmed you have fulfilled the prerequisites and standards to close to the loan because a beneficial family consumer. During this time, there can be a great about three-date mandated minimal to identify the fresh closing disclosure.

- Closing and you will capital. This is actually the history step in brand new closure processes. It will take that 3 days to receive and you can review the fresh new closed mortgage documents and you will disburse fund.

That it schedule represents the common closure day for the a loan but cannot mirror the excess time needed for home buyers having more complex financial things. The real closing alone simply bring one to two hours, but with regards to the curious family consumer’s financial predicament, the method may take longer if most papers otherwise explanation was required. To eliminate unexpected situations or complications, specific homebuyers can be interested in taking a great pre-approval toward financing.

Just how are Closure towards a great Virtual assistant Mortgage Additional?

Closing prices on a beneficial Virtual assistant mortgage are comparable to almost every other mortgage brands with a closing price from 74.3%, than the 74.1% of all the mortgages. Conventional financing provides a 75.2% closing price. Wanting a good Virtual assistant-acknowledged lender with in-home smooth underwriting services commonly expedite the method. Playing with a non-recognized lender ensures that the borrowed funds techniques would need to wade from the Va Financial Cardiovascular system and will take longer.

Pros and you will active-responsibility service individuals are necessary to create a certificate away from qualifications (CEO). So it document confirms one to services criteria try satisfied so you can qualify for that loan included in the Virtual assistant entitlement program. Just as in most other loan sizes, pre-qualifying to your a Virtual assistant financing makes the process smaller and convenient because of the exhibiting their financial youre a really interested customer. This can including prevent any shock experiences which have lower than most readily useful monetary blindspots later.

While doing so, closure moments to the Virtual assistant loans was slightly expanded. New appraisal procedure will also be a tiny various other, because the Virtual assistant requires the appraiser to evaluate from towards Minimal Possessions Requirements (MPRs) to be sure the property is sanity, structurally sound, and you can secure (the 3 S’s). Familiarizing on your own toward VA’s MPRs is expedite it section of the process because you will watch out for red flags to watch out for when examining a house. Generally, the procedure having closure into an effective Virtual assistant financing employs a comparable tips just like the other loans which have similar closing minutes as long as the latest curious home customer keeps prepared the Ceo, features their monetary ducks consecutively, as well as the individuals and their families around analysis underneath the VA’s MPRs in the assessment procedure.

Just how do Our home Financing Expert assistance?

Character Financing, Your house Loan Expert’s Virtual assistant Mortgage System. It was designed to address the new quick development of the business to take an identical passion and you may quantity of services so you can effective duty army, veterans, and their household. The mission from the Hero Financing would be to provide fast, personalized services if you find yourself support Experienced-Had enterprises and you will events. For this reason we are satisfied to support the brand new perform your pros by the causing new Fisher Domestic Basis, and therefore in person brings back into all of our veterans.

Our team out of amicable lending professionals uses a face-to-deal with approach to assist our very own readers qualify for a loan during the below five full minutes, that have closings best bank for personal loans in North Dakota in as little as 2 weeks. As previously mentioned above, having the ability in order to streamline the underwriting techniques from inside the-house form shorter closing minutes with reduced obligations having bothersome files. And, we are going to purchase the appraisal.

Let’s let explain the closing techniques because of the calling you now in the 800-991-6494 to talk to good Virtual assistant financing representative, or contact one of our financing professionals who often feel pleased to handle people questions you really have using the software.

Leave a Reply