Have you been discouraged from the home loan lending procedure? You shouldn’t be. At the Dash Mortgage brokers, i work hands-in-give with Florida homebuyers to spot a fund choice that fits their demands. For most of your army family members, that financial support option is an excellent Va home loan*.

Because the an approved Virtual assistant home lender when you look at the Fl, Dash will bring home financing lending procedure in place of almost every other. In lieu of go by way of way too many papers, i matches each borrower having a home loan Advisor that will bring suggestions and you may respond to questions as they occur. This professional people member will guarantee your home investment processes is actually simple, quick, and you will, furthermore, prompt.

When you’re a seasoned from inside the Fl and require assist closure into a western Foursquare, Dashboard Lenders helps you gamble baseball.

What is actually a Virtual assistant Financial?

Va loans are a no-money-off home financing solution open to eligible provider people, experts, in addition to their spouses. Just like the Va mortgage brokers in the Fl are secured by U.S. Company out of Veteran Products, loan providers are prepared to take a threat on a borrower exactly who may well not otherwise qualify for financial support.

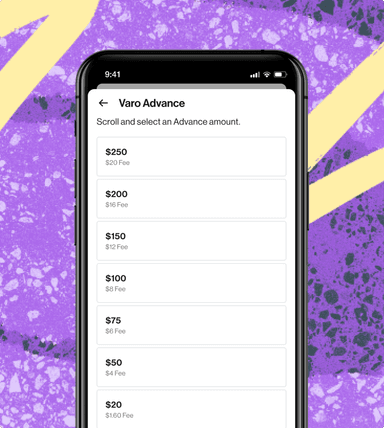

A different sort of upside is the fact Virtual https://paydayloansconnecticut.com/chimney-point/ assistant fund give well-possibly extremely-low interest* prices. As to why? Mainly because financial support products was supported by the us government, lenders learn they’ll be repaid even when the borrower defaults. Continue reading

Recent Comments