With inventory on the housing marketplace reduced, you will be offered buying an effective fixer upper rather than an excellent move-in-ready home. It’s also possible to determine one a major recovery enterprise in your current home is wise to have not receive best fixer upper to order. Sandy Springtime Bank has many choices and certainly will guide you because of the process whenever you are helping you save money and time. Very first, why don’t we take a look at particular secret stuff you must look into before deciding and therefore approach to take.

An excellent fixer upper or restoration investment on a property might possibly be as the straightforward as makeup alter like tiling, carpeting, and painting. However, it could need thorough renovations that take more time, money, and you can assistance. It’s necessary to define just what change are needed to reach finally your mission and decide your absolute best choices if you are to avoid one dangers.

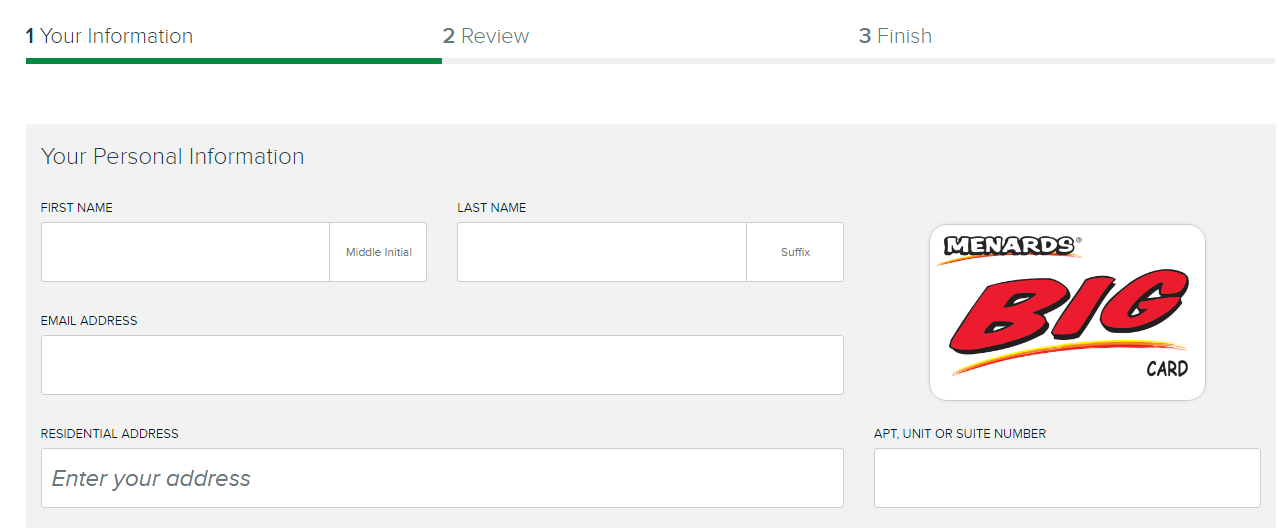

Buyers may be interested in a home collateral type of credit (HELOC) which have Exotic Spring season Bank to finance a good fixer higher

- Cost savingsOften, an excellent fixer higher enables you the advantage of bringing a reduced rate for every sqft more than a change-in-in a position house. That it initial discount can be put into their renovation will cost you. An additional benefit is that you could attract more house for your money. To buy a good fixer higher can offer alot more square feet and you may house more than a shift-in-able household and give you good long-name capital.

- Allow the ownDo you want an excellent stamped concrete deck dyed with the liking? Constantly dreamed of a different sort of kitchen having stone counter tops? You can use benefits of customizing your dream household. With a great fixer higher otherwise restoration to help you a preexisting home, you earn the benefit of delivering your eyesight your.

- Reduced competitionWith inventory low, the crowd getting winning a quote towards the a property develops dramatically. Continue reading

Recent Comments